Micky Breuer-Weil

Managing Director of Investment Policy

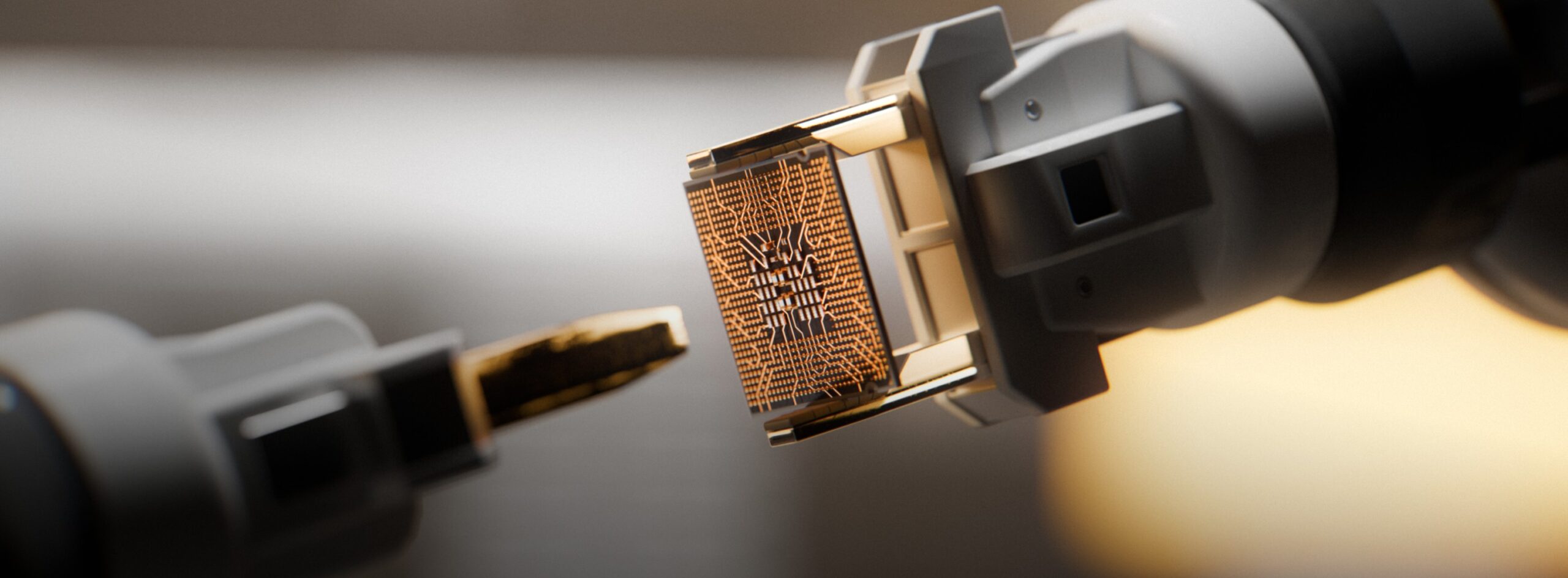

High-quality assets in private markets, held through both direct investments and specialist managers.

We target high-quality assets in private markets, aiming to generate double-digit compound returns over the long term. These investments have been a compelling source of returns for our shareholders over time for two important reasons.

Firstly, our extensive network and globally recognised brand open doors to compelling opportunities in private markets that are unavailable to most investors. We can access these investments directly, often as co-investments, or through our network of world-class specialist managers.

Secondly, our close relationships allow us to structure our investments with capital preservation in mind. For example, through a preferred position in the capital structure of a company. This ensures additional protection for our shareholders’ capital.

As at 30 June 2025

*Source: JRCM reporting. This chart provides a breakdown of the estimated top 100 positions within the private investment portfolio by sector (including those held directly and indirectly through funds.) The companies highlighted are representative of some of the largest positions, spanning both direct and indirect positions. Estimated based on the latest available funds reporting at June 2025. Quoted equities held in private investment funds have been excluded.

Learn more about our Private Investments, which have delivered 15% annualised returns over the past decade.

As at 30 June 2025. For a more detailed list of investments and latest updates please see our Half-Yearly Report June 2025.

| Investment holdings | Country/Region | Industry/Description |

|---|---|---|

| Motive | USA | Enterprise software |

| SpaceX | USA | AI & advanced technologies |

| Epic Systems | USA | Healthcare & life sciences |

| Kraken | USA | Diversified financial services |

| Blueground | USA | Consumer |

Total % of NAV – 5.0% as at 30 June 2025

| Investment holdings | Country/Region | Industry/Description |

|---|---|---|

| Thrive funds | USA | Growth equity |

| Greenoaks Capital funds | USA | Growth equity |

| Iconiq funds | USA | Growth equity |

| Ribbit Capital funds | USA | Growth equity |

| BDT Capital funds | USA | Private equity |

Total % of NAV – 14.0% as at 30 June 2025

The private direct book includes investments held through co-investment vehicles managed by a general partner (GP).

Our case study series offers a window into some of the opportunities we have invested in – both existing and realised.

Our highly skilled, hardworking in-house team are thorough yet nimble, able to move quickly and seize compelling opportunities when they arise.

Managing Director of Investment Policy

Head of Human Resources

Head of Direct Equities

Senior Investment Executive

Investment Executive, Public Equities

Director of Performance & Risk

Investment Funds Analyst

Chief Strategy & Operating Officer

Senior Independent Director

Chairman

Non-Executive Director

Non-Executive Director

Non-Executive Director

Non-Executive Director

Non-Executive Director

High-conviction, directly-held public equities and allocation to specialist managers of public equity funds across themes and geographies.

A mix of strategies with lower correlation to equity markets that aim to generate consistent returns in different market conditions.

Our flexible mandate allows for an unconstrained approach to investing, meaning effective risk management is essential to construct a well-balanced portfolio.